Business

ZENITH BANK TRANSFORMS AJOSE ADEOGUN STREET INTO A RESPLENDENT SPECTACLE WITH CHRISTMAS DECORATIONS

Published

6 months agoon

By

roamannews

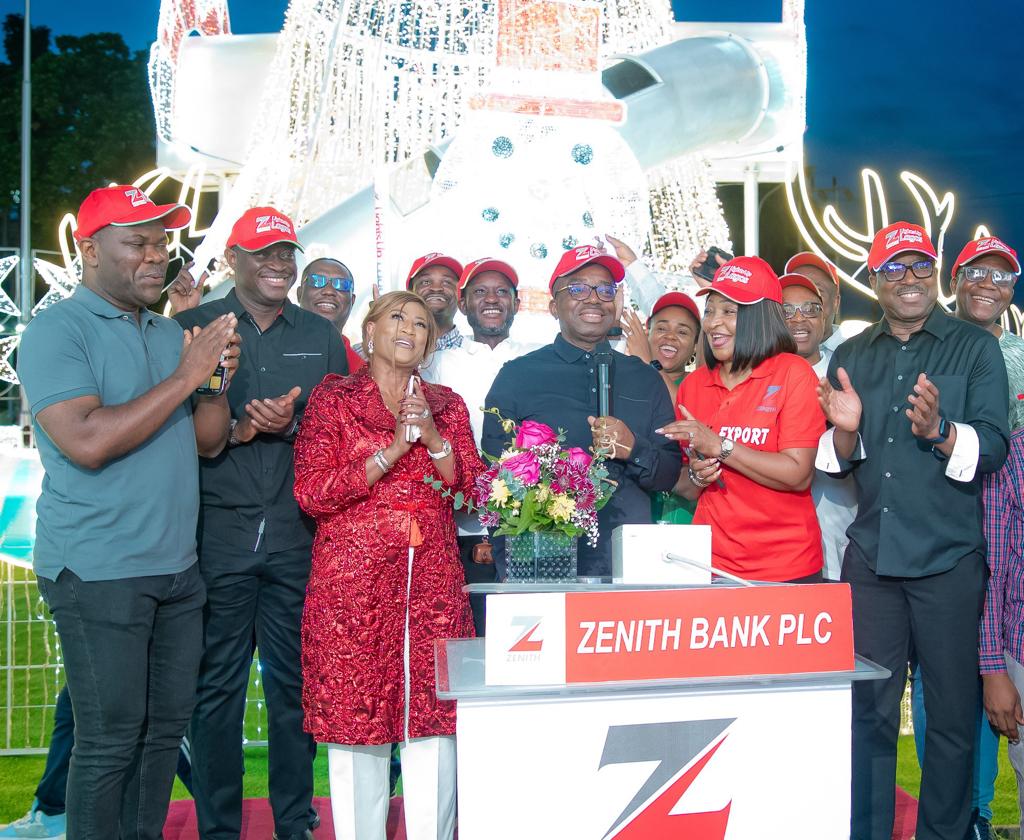

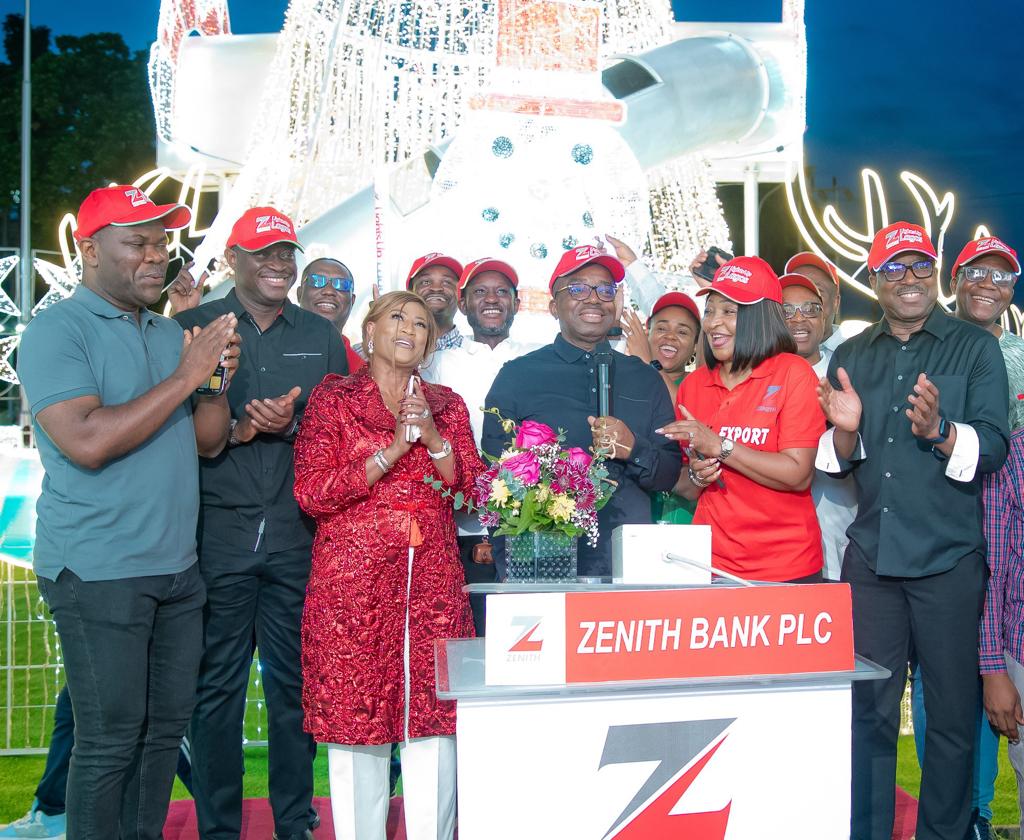

In a splendid display, Zenith Bank heralded the Christmas and Yuletide seasons with the Light-Up of Ajose Adeogun Street and Roundabout, Victoria Island, Lagos, on Saturday, 25 November 2023.

The Light-Up ceremony was performed by the Group Managing Director/CEO of Zenith Bank Plc, Dr. Ebenezer Onyeagwu.

This year’s Light Up Ceremony, the 17th of its kind, is a Corporate Social Responsibility initiative by Zenith Bank.

The Group Managing Director/CEO of Zenith Bank Plc, Dr. Ebenezer Onyeagwu (4th Left) flanked by the wife of the Founder and Chairman of Zenith Bank Plc, Mrs. Kay Ovia (3rd Left); Executive Director, Mr. Henry Oroh (1st Left); Executive Director, Dr. Temitope Fasoranti (2nd Left); Executive Director, Mrs Adobi Nwapa (2nd Right); and Executive Director, Mr. Akin Ogunranti (1st Right) at the 2023 Zenith Bank Christmas Light-Up of Ajose Adeogun Street, Victoria Island, Lagos at the weekend.

The Christmas decoration is a Corporate Social Responsibility (CSR) initiative of the bank to herald the Yuletide season through the beautification and transformation of the entire stretch of Ajose Adeogun Street (home to Zenith Bank’s Corporate Headquarters) and Roundabout into a resplendent spectacle – which has come to be recognised as an iconic tourist attraction, attracting people from all walks of life who visit with their families and friends to take pictures and make videos of the beautiful spectacle, especially at night and enjoy the ambience of the street and season.

Speaking during the ceremony, Dr. Onyeagwu expressed his delight in heralding the 2023 Yuletide season by lighting up the iconic Ajose Adeogun Street and Roundabout.

He urged everyone to imbibe the message and spirit of Christmas, which is about peace, love, forgiveness and respect for humanity and prayed for peace in every home, business and country.

In his words,

“Today, as we turn on the Christmas light with the wife of our Founder and Chairman, Mrs. Kay Ovia, in our midst, we hope with this, we activate the spirit of Christmas in the minds of everyone. We pray that the ambience of the light brings warmth, love, joy, fulfilment, and hope to every one of us. We pray that our country will experience peace. We pray that our joy will be full in this season of joy. So, in the spirit of the Yuletide season, Zenith Bank is also demonstrating that we want to use this to continue communicating and connecting with the community.”

He lauded the efforts of Quantum Markets, who have been responsible for the annual decorations, for their outstandingly creative and beautiful work.

According to him, “It is an amazing evening! First and foremost, we need to thank Quantum Markets for the incredible work they are doing. You know, every year, the theme, the style and the ambience look completely different, and today, in a few minutes, we are going to be turning on the light, and you are going to see that it is nothing compared to what you have seen anywhere in the world. I have had the privilege of seeing Christmas light in so many cities across the world, and I say without any sense of contradiction that none compares with what we have in Lagos, Nigeria.”

The bank’s sustainability and CSR initiatives are hinged on the belief that today’s business performance is not all about the financial numbers – the bank believes that an institution’s social investments, contributions to inclusive economic growth and development as well as improvements in the condition of the physical environment, all constitute a balanced scorecard.

Through its CSR initiatives, Zenith Bank has embodied the overarching objective of the 17 Sustainable Development Goals (SDGs), which provide a framework for addressing the major challenges confronting society.

Its social investments are targeted at health, education, women and youth empowerment, sports development and public infrastructure enhancement. Overall, Zenith Bank’s total CSR investment in 2022 was NGN1.67 billion, representing 0.75% of its Profit After Tax (PAT).

The bank remains committed to furthering the economic, cultural and social development of host communities, particularly through community-based initiatives and philanthropy. As a good corporate citizen, it continues to deliver projects that have long-term social and economic benefits for the communities because it believes that its business is only as strong as its host communities.

To demonstrate its commitment to creating and expanding opportunities, the bank regularly makes donations towards setting up ultramodern ICT centres in several educational institutions and cities across the country.

It also supports various developmental projects and healthcare delivery causes in Nigeria and contributes to the development of sports in Nigeria through its sponsorship of the Zenith Women Basketball League, Zenith Bank Delta State Principals’ Cup, and Zenith Bank Delta State Headmasters’ Cup, amongst others.

In recognition of its contributions and social investments to its host communities and the society at large, the bank was recognised as the “Most Sustainable Bank, Nigeria” in the International Banker 2023 Banking Awards and “Most Responsible Organization in Africa” at the Sustainability, Enterprise, and Responsibility (SERAS) Awards 2021.

You may like

Business

ZENITH BANK’S LANDMARK N125.59 BILLION DIVIDEND PAYOUT EXCITES SHAREHOLDERS

Published

1 week agoon

May 11, 2024By

roamannews

Shareholders of Zenith Bank Plc, at the 33rd Annual General Meeting (AGM) held at the Civic Centre, Victoria Island, Lagos, on Wednesday, 8 May 2024, approved the proposed final dividend payment of NGN3.50 per share, bringing the total dividend for the 2023 financial year to NGN4.00 per share, with a total value of NGN125.59 billion, which is the highest dividend payout by any bank.

In his opening statement at the Annual General Meeting, Dr. Jim Ovia, CFR, Founder and Chairman of Zenith Bank Plc, thanked the shareholders for their unflinching support and loyalty to the Zenith brand which has been instrumental to the bank’s consistent superior performance.

The Group Managing Director/Chief Executive Officer, Dr. Ebenezer Onyeagwu, thanked the Founder and Chairman, Jim Ovia, CFR, for his mentorship, which has been instrumental to his success in the last five years as CEO, and for providing the pedestal for the bank’s continued superior performance. In his words, “As I prepare to pass the baton to Dame (Dr) Adaora Umeoji, OON, I am confident in the bank’s trajectory under her leadership. I would like to express my profound gratitude to our Founder and Chairman, Dr Jim Ovia, CFR, and to the board, shareholders, customers, and staff for their steadfast support throughout my tenure. I earnestly request that you extend the same level of support to my successor. It has been a remarkable journey, and I am immensely proud of what we have accomplished together. As I commence the mandatory regulatory cooling-off period, I am filled with optimism for Zenith Bank’s future, assured that we are on the path to even greater success.”

Speaking on the dividend payout, Mrs. Bisi Bakare, National Coordinator of the Pragmatic Shareholders Association of Nigeria, expressed her delight in the exceptional performance of the bank, as evidenced by the numerous awards received during the 2023 financial year. She remarked, “We shareholders are very pleased today to receive a final dividend of N3.50 kobo from Zenith Bank. Following an interim dividend of 50 kobo paid last December, the total dividend for the 2023 Annual General Meeting amounts to N4.00— the highest in the banking sector to date. We truly appreciate this and are optimistic that the transition to a Holding Company will bring even greater returns. Zenith Bank’s numerous accolades this year clearly position it as the leading bank in the country. We anticipate that the 2024 AGM, marking the first year as a Holding Company, will be even more promising for Zenith.”

At the AGM, Dr. Faruk Umar, President of the Association of the Rights of Nigerian Shareholders (AARNS), expressed his gratitude to the Chairman for facilitating a seamless succession plan. He stated, “The bank has performed exceptionally well, particularly in terms of succession planning. It’s encouraging to see the new Managing Director promoted from within, reinforcing our belief in the bank’s leadership development. This internal promotion strategy motivates our staff, giving them confidence that they can aspire to the highest levels within the bank.”

Chief Timothy Adesiyan, President of the Shareholders Solidarity Association of Nigeria, praised the Chairman and Management of Zenith Bank for their consistent delivery of value to shareholders. He noted, “The bank’s rapid growth can be attributed to the diligent oversight by our Founder, who is also a core investor and actively monitors all operations. This growth is further supported by our adherence to strict corporate governance principles. The bank’s performance metrics are clearly delineated and managed by dedicated committees, ensuring accountability and responsiveness. As a stakeholder, I am very pleased with their performance and attentive response to any concerns raised.”

In spite of challenging macroeconomic conditions coupled with economic headwinds, Zenith Bank Group achieved a remarkable triple-digit growth of 125% in gross earnings, from NGN945.6 billion in the previous year to NGN2.132 trillion in 2023. This was driven by a 112% YoY growth in interest income and a 141% YoY growth in non-interest income. Customer deposits grew by 69%, reflecting the bank’s market leadership and customers’ trust. Operating expenses grew by 32% YoY. Total assets rose by 66%, largely due to growth in total deposits and the revaluation of foreign currency deposits

In 2024, Zenith Bank Group plans to expand its reach following its restructuring into a holding company structure, adding new verticals to its businesses and pursuing growth in all chosen markets, locally and internationally.

Zenith Bank’s track record of excellent performance has continued to earn the brand numerous awards, including being recognised as Best Bank in Nigeria, for the fourth time in five years, from 2020 to 2022 and in 2024, in the Global Finance World’s Best Banks Awards; the Best Bank for Digital Solutions in Nigeria in the Euromoney Awards 2023, being listed in the World Finance Top 100 Global Companies in 2023; being recognised as the Number One Bank in Nigeria by Tier-1 Capital, for the 14th consecutive year, in the 2023 Top 1000 World Banks Ranking published by The Banker Magazine; Best Commercial Bank, Nigeria, for three consecutive years from 2021 to 2023, in the World Finance Banking Awards; Best Corporate Governance Bank, Nigeria in the World Finance Corporate Governance Awards 2022 and 2023; Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards 2020 and 2022; Best in Corporate Governance’ Financial Services’ Africa, for four successive years from 2020 to 2023, by the Ethical Boardroom; Most Sustainable Bank, Nigeria in the International Banker 2023 Banking Awards; Best Commercial Bank, Nigeria and Best Innovation in Retail Banking, Nigeria in the International Banker 2022 Banking Awards.

Also, the bank emerged as the Most Valuable Banking Brand in Nigeria in the Banker Magazine Top 500 Banking Brands 2020 and 2021; Bank of the Year 2023 and Retail Bank of the Year for three consecutive years from 2020 to 2022, at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards. Similarly, Zenith Bank was named Bank of the Decade (People’s Choice) at the ThisDay Awards 2020, Bank of the Year 2021 by Champion Newspaper, Bank of the Year 2022 by New Telegraph Newspaper, and Most Responsible Organisationin Africa 2021 by SERAS

Business

WEMA BANK UNVEILS NEW DIGITAL SOLUTION FOR COOPERATIVE SOCIETIES, COOPHUB

Published

1 week agoon

May 11, 2024By

roamannews

Wema Bank, Nigeria’s foremost innovative bank and pioneer of Africa’s first fully digital bank, ALAT, has officially launched CoopHub, a new digital solution for Cooperative Societies. The groundbreaking platform was unveiled at the launch ceremony held on May 10th, 2024, to commemorate the 79th anniversary of the Bank.

CoopHub, the first of its kind in the Nigerian banking industry, is a digital platform designed strategically to transform the way Cooperative Societies operate by providing tailored solutions that bridge the gaps in the traditional framework of Cooperative Societies. The unique platform insulates Cooperative Societies against prevalent struggles like manual recordkeeping, limited access to loans, poor communication, insecurity, and other restrictions, supporting them with the solutions needed to not only mitigate these problems but also operate with the utmost efficiency.

With CoopHub, leaders of Cooperative Societies can manage every aspect of their community’s operations from a simplified dashboard accessible on their phones, seamlessly managing their Cooperative Society’s finances, communication, member records, analytics and every other detail in real time and on the go. Members of the Cooperative Societies also enjoy increased access to loans, seamless contribution tracking, secure transactions, and easy communication with the leaders. Essentially, CoopHub helps Cooperative Societies maintain 100% transparency, reliability, and security, with the option of white labelling for a customised experience.

Disclosing the Bank’s motive for creating CoopHub, Wema Bank’s MD/CEO, Moruf Oseni, highlighted the Bank’s commitment to innovation and customer-centricity. “Cooperative Societies have many pain points. As a bank that is committed to empowering lives through innovation, we examined the end-to-end value chain of Cooperative Societies and launched CoopHub to provide solutions that address the pains and headaches in the Cooperative Society experience for both the leaders of these communities and the members. CoopHub is the future of Cooperative Societies and we have designed every detail to address the needs of every player in the Cooperative Society ecosystem and empower these communities for optimal productivity”, he said.

Delving into the unique features of CoopHub, Solomon Ayodele, Wema Bank’s Head of Innovation, added, “CoopHub is taking Cooperatives to an era where conflicts, stressful physical meetings, mistrust, inadequate capital, poor recordkeeping and inefficient governance are all a thing of the past. With a digitised database for all records, a dedicated User Management section for leaders to manage members efficiently, a transparent overview of contributions for both leaders and members, seamless communication framework that allows for easy planning of meetings and events, and a host of other unique features, CoopHub truly is the solution that every Cooperative Society needs. To promote community and financial security, CoopHub also offers a three-factor authentication system that ensures that every withdrawal from the Cooperative Society’s account is subject to an approval of three members of the Cooperative Society, including the Admin. We have been very intentional with CoopHub and I encourage every Cooperative Society to come on board and experience the future of Cooperative Societies through CoopHub”, Ayodele concluded.

CoopHub is now live and open to every Cooperative Society across the world. This futuristic solution is set to not only empower Nigerian lives with increased access to their needs through Cooperative Societies, but also revolutionise Cooperative Society operations for the best.

To onboard a Cooperative on CoopHub, simply register at https://coophub.alat.ng/

ZENITH BANK’S LANDMARK N125.59 BILLION DIVIDEND PAYOUT EXCITES SHAREHOLDERS

WEMA BANK UNVEILS NEW DIGITAL SOLUTION FOR COOPERATIVE SOCIETIES, COOPHUB

ZENITH BANK ON TRACK TO SURPASS 2023 RESULTS WITH 189% GROWTH IN Q1 EARNINGS

ZENITH BANK, AfCFTA JOIN FORCES TO REVOLUTIONIZE AFRICAN TRADE

BREAKING! Many Injured In Hoodlum Clash In Ile-Epo Lagos Market

Wema Bank Celebrates Remarkable Journey of 79 years

100-level Student’s Mysterious Death Sparks Foul Play Suspicions

NANS Warns Against Propaganda Targeting Power Minister

Ronaldo and Mane Dominate as Al Nassr Triumphs in King Cup Semifinal Showdown

BREAKING! Police Raid Ex-MFM Member’s Home, Spare Wife for Kids’ Sake Amidst Cyberbullying Saga

EFCC Chairman Threatens To Resign If Yahaya Bello Is Not Prosecuted

JUST IN: Oba Of Benin Suspends Six Officials For Impersonation

Anambra Traders Takes Legal Action Against Soludo

How Air Peace Airline Disappointed Me

JUST IN: Bandits Attack Zamfara Palace To Capture Emir

Retired General and Thugs Clash Over Property in Abuja ( VIDEO)

Fresh Update On Unexpected Fire Outbreak In Lagos Airport

Why I stopped My Son From Playing Chess – Tunde’s Father

Napoli Falls to Empoli in Crushing Defeat

JUST IN: NAFDAC Arrests CEO Of Pasco Global Limited

1 Comment